- Home

- Anmo Blockchain Ecosystem

- Anmo Online Marketplace

- Supply Chain Finance

- Anmo Wallet

- Fishing Game

- Block Explorer

- Anmo news

- About>>

Supply chain finance status

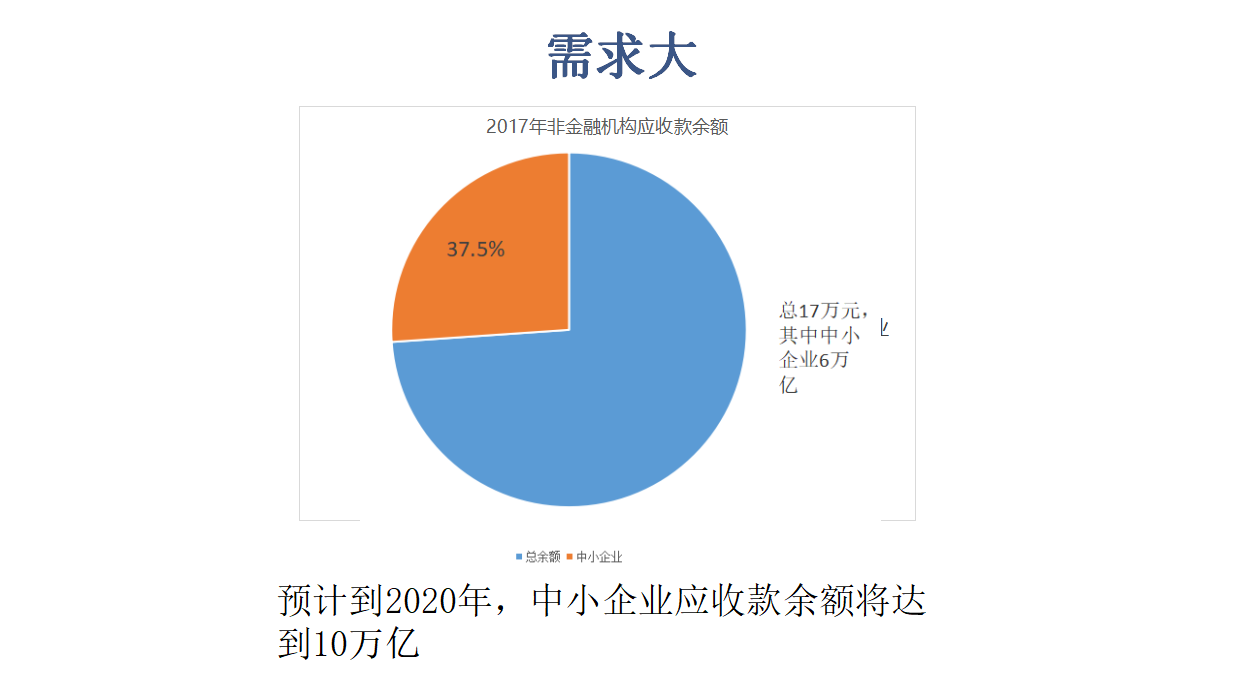

Large demand: The balance of total receivables of SMEs at the end of 2016 was 6 trillion yuan; the total receivables are expected to reach 10 trillion yuan by 2020

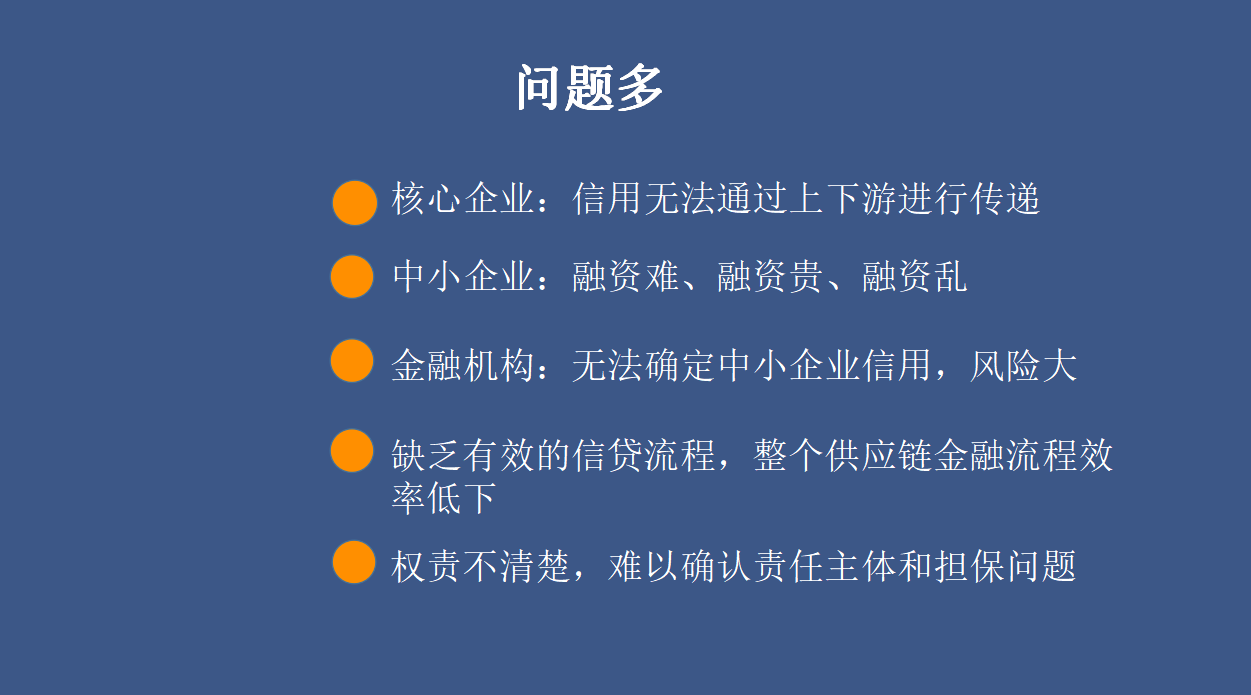

There are many problems: “Financing, financing, and financing” have always been a problem that has plagued the development of Chinese companies, especially small and medium-sized enterprises. The small anti-risk, uncollateralized, and small size of small and medium-sized enterprises have led to high financing costs.

Supply Chain Financial Management and Risk Prevention SaraLai, executive director of Northeast Asia's trade finance products at Standard Chartered Bank, said that the main risk nodes of supply chain finance mainly appear at four nodes: whether to maintain a good supply chain relationship with core companies, and whether they fully understand financing Whether the company's operation or profitability, whether there is a real trade background, whether the goods value and cargo rights are properly controlled.

Lack of effective credit process efficiency, it is difficult to confirm the subject of responsibility

Development stage: The development process of domestic supply chain finance is roughly divided into three stages. The first stage relies on basic products to provide individual credit for enterprises.

In the second stage, relying on the credit granting of core enterprises, and the “1+N” model. “1” refers to one core enterprise, “N” refers to the upstream and downstream enterprises of core enterprises, and is an associated network enterprise model focusing on wholesale and development of marketing industry chain clusters.

In the third stage, explore the use of large numbers of laws and big data, blockchain and other technical means to dilute the credit impact of core enterprises.

ANMO Solution: Blockchain Technology Solves Supply Chain Challenges

As an important means to solve the financing problems of small and medium-sized enterprises, supply chain finance has also become the focus of the financial industry. The development of cloud computing, big data, Internet of Things and blockchain technology further enhances the risk control capability of supply chain finance and reduces the overall cost of business.

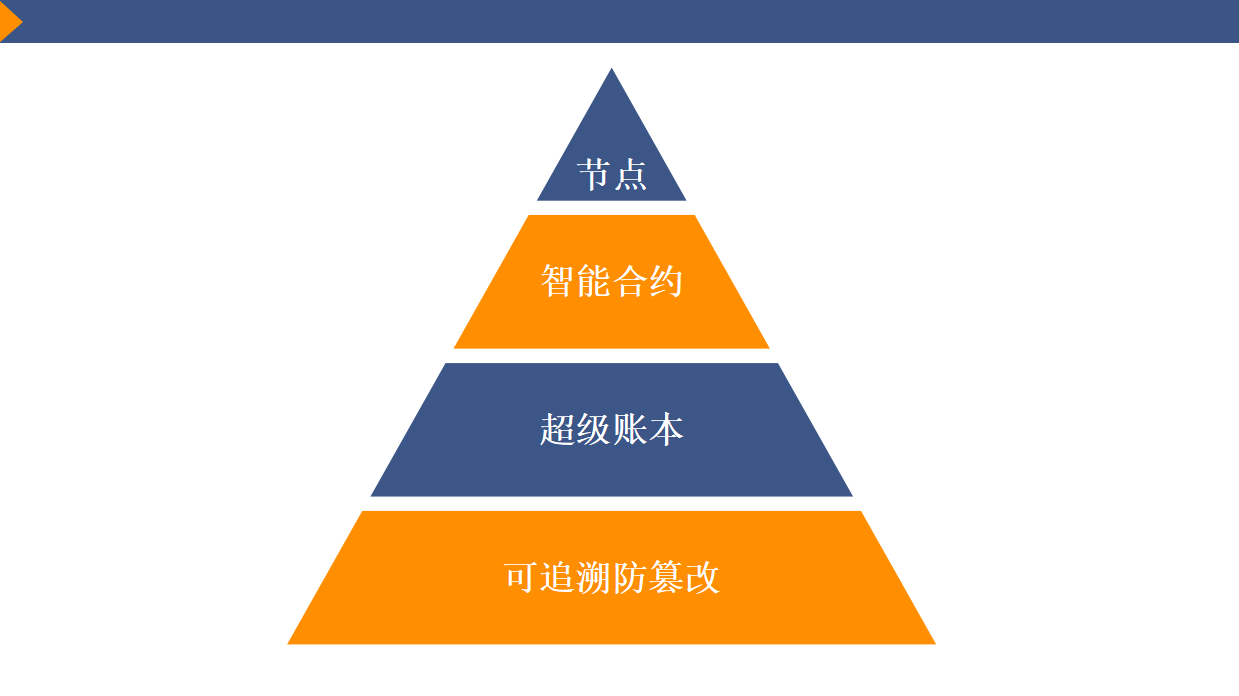

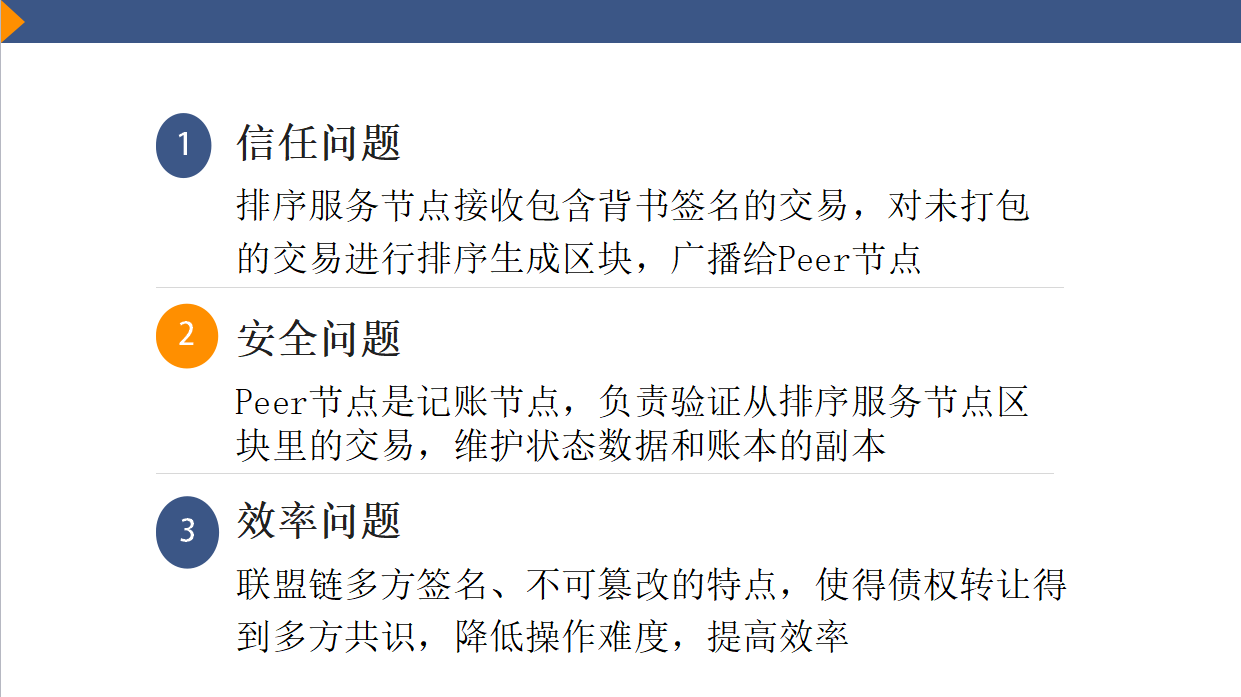

ANMO Supply Chain Financial Platform can use the blockchain technology to trace the advantages of anti-tampering, combine peer nodes, smart contracts, and super-book technology to solve the problem of trust in supply chain finance, solve the financing problems of small and medium-sized enterprises, and solve the financing trust of financial institutions. The problem is to improve the risk control ability of supply chain finance, reduce the comprehensive cost of business, and revitalize the platform for depositing funds in the supply chain.

ANMO Supply Chain Financial Platform Introduction

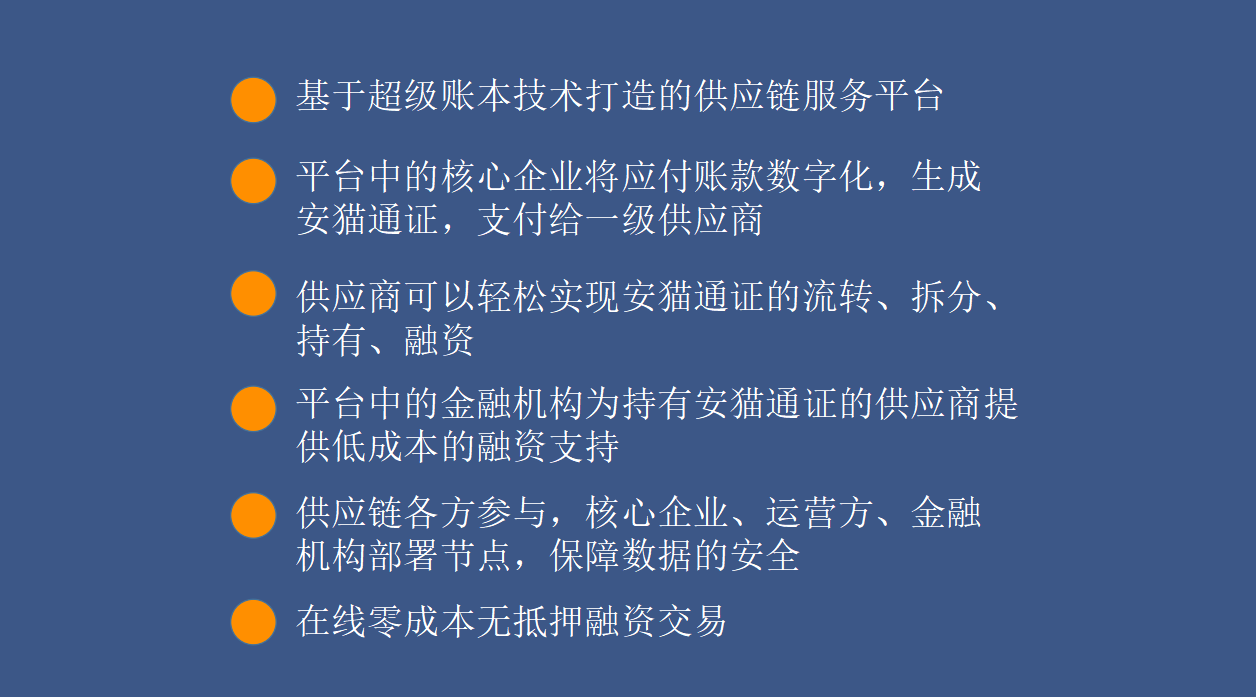

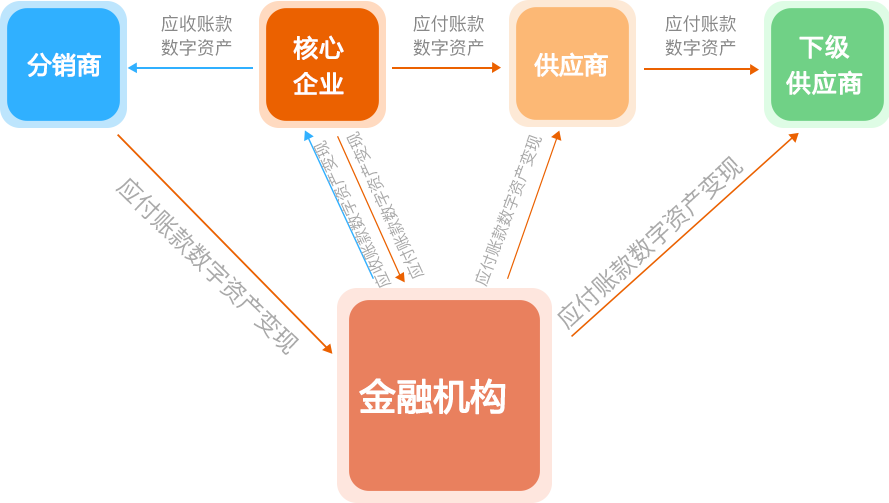

The ANMO Supply Chain Financial Platform is based on the Hyperledger Fabric blockchain technology, which allows all parties in the platform to participate in the maintenance of books, real-name authentication, security and solve industry trust issues. Specially create two financing modes of accounts receivable and accounts payable, with core enterprises and financial institutions as the main service targets, connecting upstream and downstream of the supply chain, no capital pool, safer, transparent and efficient supply chain financial platform.

ANMO is committed to transferring the credit value of core enterprises through its financial institutions in its upstream and downstream, providing financing and circulation for upstream and downstream enterprises in the supply chain centered on core enterprises, and achieving docking with financial institutions. And a special mechanism for blockchains to avoid cost risks for financial institutions.

In other words, ANMO Supply Chain Financial Platform is a platform for information exchange and capital transfer for core enterprises, financial institutions, second- and third-tier suppliers and distributors. The purpose is to revitalize the funds of all parties and promote the competitiveness of the supply chain; The funds of all parties are transferred by voucher to ensure the security of the account.

ANMO Supply Chain Financial Service Platform Advantage

Financial institution:

1. Accelerated fund docking: combined with the core credit advantage, and the high-quality suppliers, distributors, and core enterprises on the platform to achieve financial docking, can become their customers

2. Reduce the cost of obtaining customers: Utilize the advantages of the block network platform of ANMO, effectively reduce the cost of obtaining financial institutions

3. Reasonable risk control: Blockchain technology prevents tampering, data transparency, reduces default risk, and reduces bad debt risk

4. Shorten audit costs: use core enterprise endorsement vouchers to shorten audit fees for corporate credit

5. Shorten the adjustment cycle: core enterprise credit transfer and voucher endorsement can speed up the lending cycle, reduce the cost of lending, improve the asset quality of financial institutions, and profitability

6. Delivering credit value: Integrating institutional credit into the actual purchase and sale behavior of enterprises within the supply chain, thus solving the problem of imbalance in supply chain funds

Core business:

1. Improve the cohesiveness of the supply chain: As a core enterprise upstream and downstream supply chain enterprises, and also a part of the core enterprise 'loose coupling', the cohesiveness of the supply chain may directly affect the survival and development of enterprises.

2. The physical assets receivable or payable are voucherized and digitized: The Ancat supply chain financial platform can expand the credit value of the core enterprises, so that the physical assets receivable or payable by the upstream and downstream cooperative enterprises of the core enterprises are voudentized and digitized, thus making the core enterprises The realization of credit transfer, the transfer of asset value, and the rapid response capability of the supply chain system

3. A virtuous circle of logistics, information flow, and capital flow: the introduction of the alliance chain makes the entire supply chain based on core enterprises more flexible and more benign

4. Improve brand influence: increase the efficiency of corporate capital revitalization, ease capital shortage, and help stabilize old customers, develop new customers, increase the flexibility of supply chain financial mechanism; optimize financial structure, strengthen cooperation between banks and enterprises, optimize circulation model, Conducive to capitalization

5. Dividend sharing, multi-win, and improving supply chain competitiveness: Obviously, in the alliance system such as Anma Supply Chain Finance, suppliers and distributors can share some credit dividends of core enterprises to some extent, and even share financial institutions. Part of the bonus, to achieve a true multi-win

supplier:

1. Resources and Dividend Sharing: The assets delivered by the supplier to the core enterprise are issued through the vouchers of the core enterprises of the ANMO Supply Chain Financial Platform, which enable the physical assets of the supplier to be voucherized and can be transferred, and the core enterprises endorse and make the assets more Valuable and faster access to financing from relevant financial institutions in the ANMO Supply Chain Financial Platform, thereby gaining resource sharing and dividends

2. Rapid financing to solve the shortage of liquidity: Suppliers can obtain the transferable/financing of the vouchers from the core enterprises of the ANMO supply chain financial platform, and reduce the financial pressure on suppliers.

3.Enhance the company's own value and competitiveness: As a part of the ANMO supply chain financial alliance chain, it is more conducive to the cooperation between encryption and core enterprises, more orders from core enterprises, and enhance the value of enterprises from mutual benefit. At the same time, the sub-suppliers as core enterprises are more competitive.

Distributor:

1. Resources and Dividend Sharing: The assets delivered by the supplier to the core enterprise are issued through the vouchers of the core enterprises of the ANMO Supply Chain Financial Platform, which enable the physical assets of the supplier to be voucherized and can be transferred, and the core enterprises endorse and make the assets more Valuable and faster access to financing from relevant financial institutions in the ANMO Supply Chain Financial Platform, thereby gaining resource sharing and dividends

2. Rapid financing to solve the shortage of liquidity: Suppliers can obtain the transferable/financing of the vouchers from the core enterprises of the ANMO supply chain financial platform, and reduce the financial pressure on suppliers.

3. Enhance the company's own value and competitiveness: As a part of the ANMO supply chain financial alliance chain, it is more conducive to the cooperation between encryption and core enterprises, more orders from core enterprises, and enhance the value of enterprises from mutual benefit. At the same time, the sub-suppliers as core enterprises are more competitive.

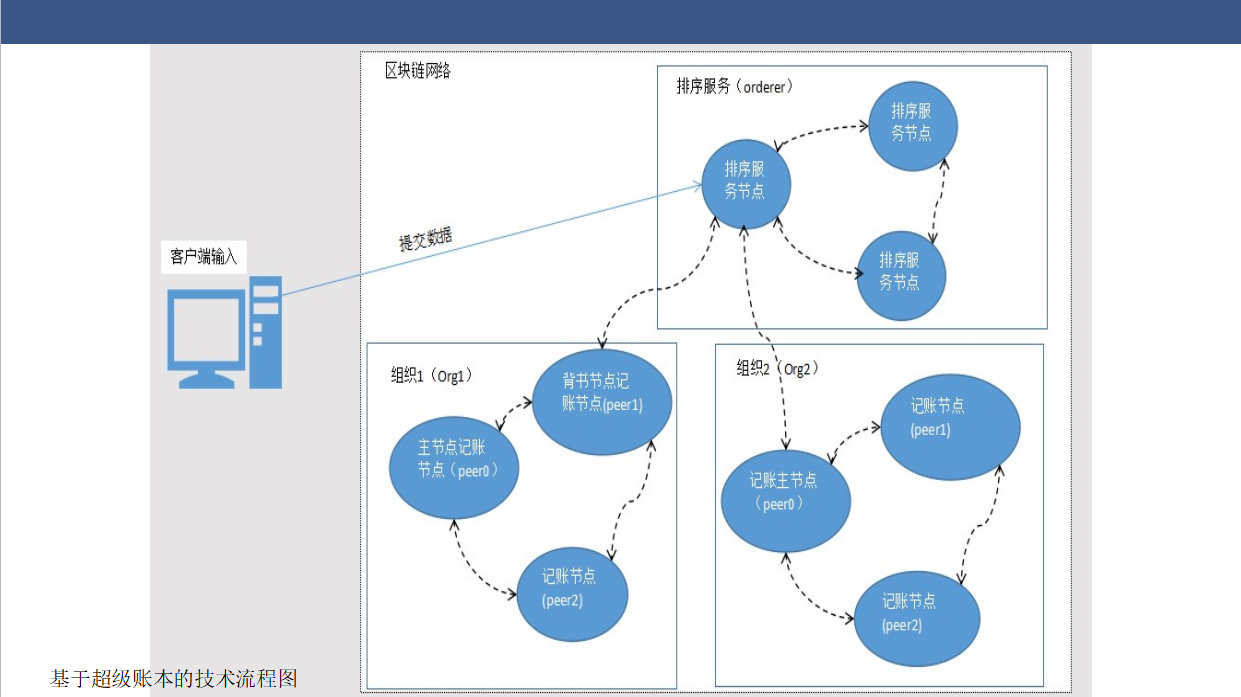

ANMO Supply Chain Financial Platform Technical Support

The federated blockchain is a blockchain that is controlled by pre-selected nodes during its consensus process. The alliance chain is jointly maintained by the member nodes in the alliance. After the node is authorized, the node can join the network. For example, a community of 15 financial institutions, each of which runs a node, and in order to make each block effective, it needs to obtain confirmation from 10 of them (2/3 confirmation). The alliance chain is a kind of private chain, but the degree of private ownership is different, and its permission design requirements are more complicated than the private chain; but the alliance chain is more credible than the pure private chain.

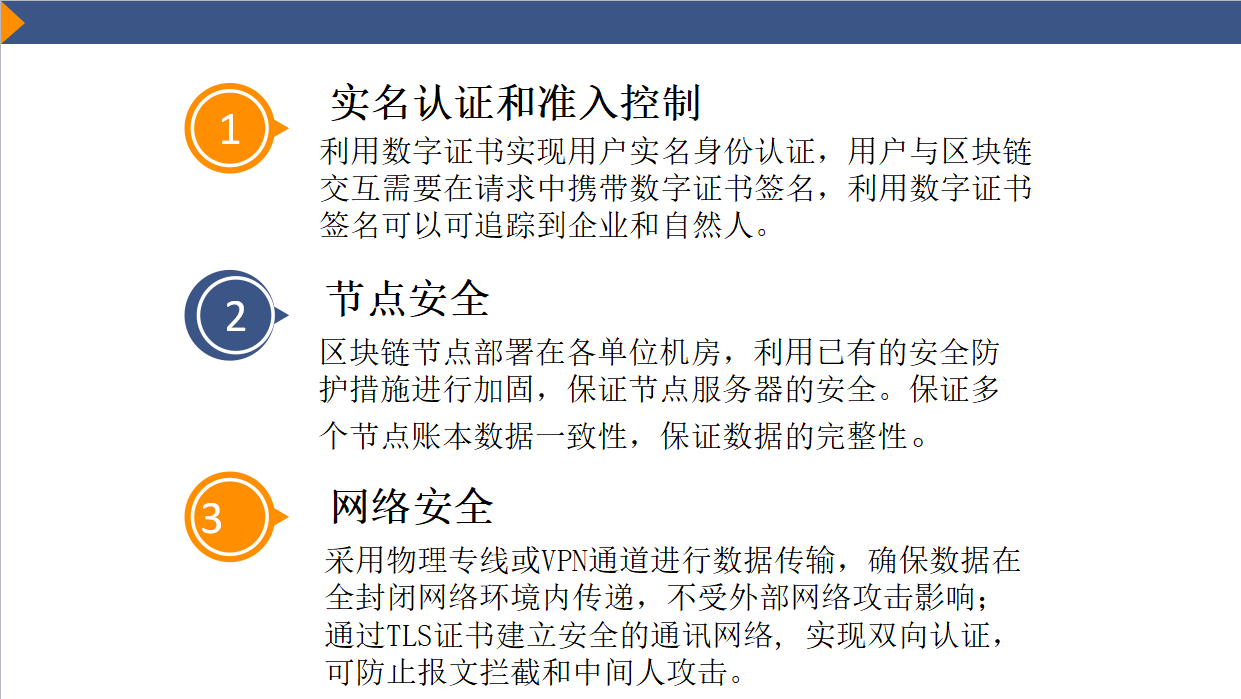

The ANMO Supply Chain Financial Platform adopts a coalition chain to allow multiple parties to participate in the maintenance and jointly maintain the security of the books. Have five major technical advantages, protect the security of the books, and solve the problem of trust in supply chain finance。

阅读更多>>

阅读更多>>